2025 Practical Guide to Bitcoin: Understanding Its Value, Mining Principles, and Equipment Selection

2025年08月27日

Since the creation of Bitcoin’s genesis block in 2009, this blockchain-based digital asset has evolved over more than a decade—from a technical experiment in the geek community to a vital component of the global financial market. By 2025, Bitcoin, with a market capitalization exceeding $1 trillion, continues to dominate the cryptocurrency sector as the most valuable asset. It has not only gained widespread recognition from institutional investors but also built a vast global ecosystem. This guide will deeply analyze the logic behind Bitcoin’s value, its underlying mining mechanism, systematically outline strategies for selecting mining equipment, and highlight Bitmain’s core role in the industry chain—helping you fully master key knowledge for Bitcoin investment and mining operations.

What Exactly Is Bitcoin, and Why Remains It Relevant Today?

Bitcoin is a decentralized digital currency, free from control by any bank, government, or enterprise. It operates on a blockchain network composed of computers worldwide, where all transactions are verified by the network to ensure security and transparency.

In 2025, Bitcoin remains crucial for three primary reasons:

Scarcity: Bitcoin has a fixed total supply of 21 million coins. As of 2025, over 19 million have entered circulation. Over time, the “mining” difficulty for the remaining coins continues to increase. This scarcity positions Bitcoin as a high-quality asset against inflation—much like gold in traditional finance—making it highly favored by investors.

Mainstream Acceptance: Bitcoin’s adoption has expanded significantly. Instead of outright bans, many countries have introduced regulatory frameworks, enhancing its legitimacy for daily use and further promoting its global circulation.

Decentralized Nature: Bitcoin’s decentralized architecture serves as the anchor of its core value, building a highly autonomous financial ecosystem. This technical feature breaks the centralized constraints of traditional finance: no single institution can unilaterally shut down the Bitcoin network or alter its operating rules. For investors seeking asset autonomy and freedom from the constraints of traditional banking systems, this decentralization acts as a security barrier—empowering users to truly control their assets and become the absolute owners of their digital wealth.

Bitcoin Mining: Principle Analysis

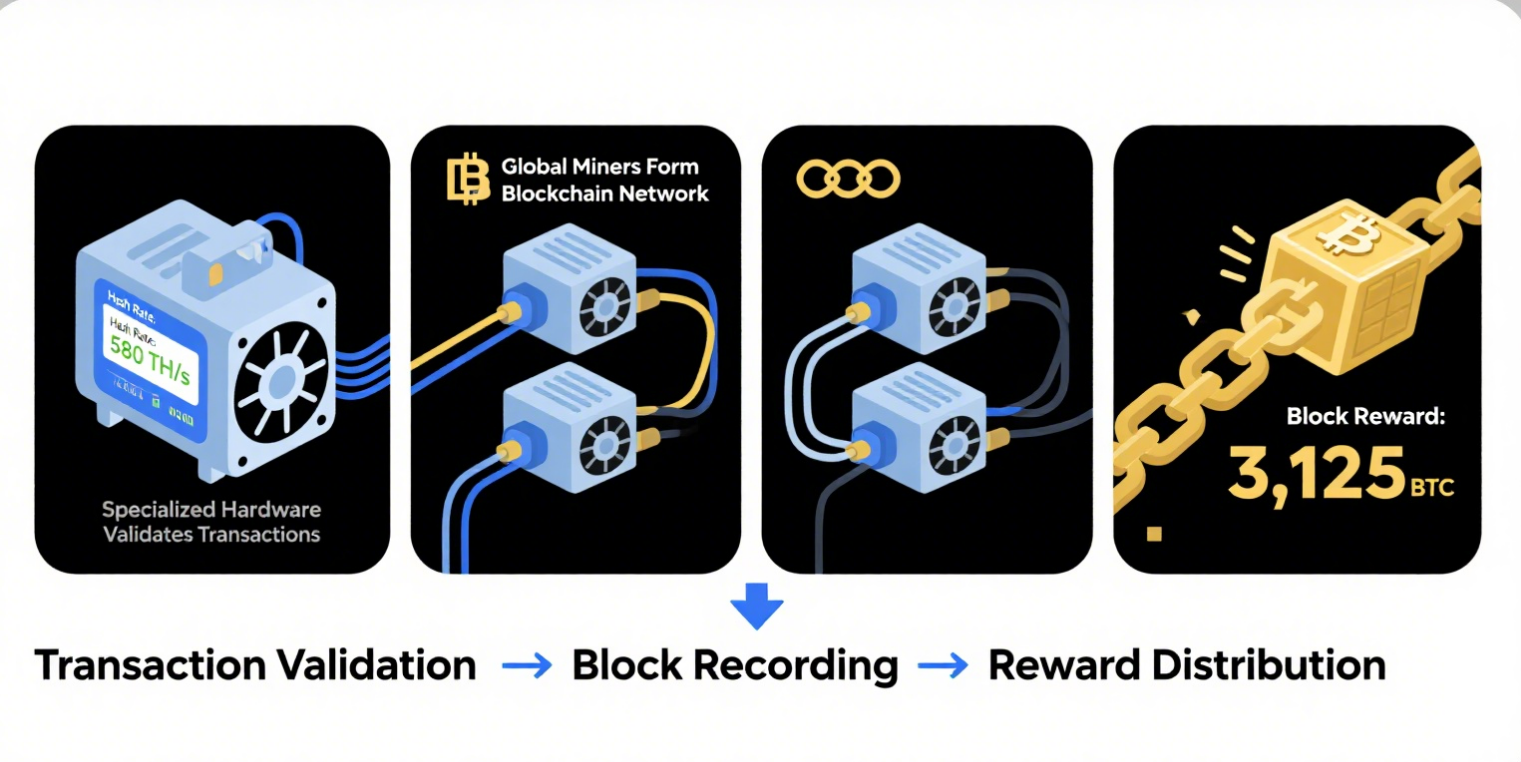

Bitcoin mining is not “mining” in the literal sense; it is a process that secures the operation of the Bitcoin network. When a Bitcoin transfer occurs, the transaction must be verified to prevent fraud (e.g., double-spending the same Bitcoin). Miners use specialized computers to validate these transactions and record them on the blockchain. In return, the Bitcoin network rewards miners with a certain amount of Bitcoin—known as the “block reward.”

2025 Bitcoin Mining Trends: What Should Miners Focus On?

Conversations with seasoned Bitcoin miners in 2025 reveal three key trends shaping the industry:

Water-Cooled Miners Become Mainstream: Traditional air-cooled miners face significant heat dissipation issues—equipment overheats easily during operation, reducing hash rate and shortening lifespan. In contrast, water-cooled miners (e.g., Bitmain’s S23 Hyd.) use liquid to quickly dissipate heat, operating more quietly with more stable performance and lower overall energy consumption. Many miners report that water-cooled miners are approximately 30% more efficient than air-cooled models, making them a revolutionary solution for mining in warm climates or limited spaces.

Renewable Energy Becomes a Necessity: Mining consumes massive amounts of electricity, so high electricity costs remain a major challenge for miners. Additionally, growing environmental awareness has sparked debates about Bitcoin’s carbon footprint. As a result, more miners are integrating mining farms with solar panels, wind turbines, or hydropower systems to use renewable energy. This not only reduces long-term mining costs but also helps miners avoid criticism of “excessive Bitcoin carbon emissions,” aligning with sustainable development trends.

Return of Small-Scale Mining: A few years ago, Bitcoin mining was dominated by large enterprises, requiring massive data centers and substantial capital investment. Today, compact, high-efficiency miners enable ordinary individuals to start mining in garages or basements. No large warehouses are needed—only a stable power supply and suitable equipment. This has revived small-scale mining, opening up opportunities for more people to participate.

How to Choose a Bitcoin Miner in 2025?

Bitmain S23 Hyd.: The Benchmark of Outstanding Performance

Conclusion

In 2025, Bitcoin’s position as a decentralized currency and investment tool will become increasingly solid. While its price may fluctuate, its influence in the global financial market will not fade easily. If you are interested in Bitcoin mining, mastering basic knowledge and selecting suitable equipment are critical. Bitmain’s miners—such as the S23 Hyd. and Antminer S21e XP Hydro 3U—with their high hash rate, stability, and cost-effectiveness, are ideal for navigating the 2025 Bitcoin mining landscape. Of course, the market offers many other high-performance miners to suit diverse needs.

Whether you are a new miner just starting out or a seasoned professional looking to upgrade equipment, take time to research available options. For a miner tailored to your existing mining environment, visit Bitmain’s official website at www.bitmain.com to explore its full product range—you are sure to find the right fit.

If you have already selected or prepared your miner and need supporting liquid-cooling equipment, visit https://www.lianliwork.com or https://lianli.tech to explore their full line of liquid-cooling solutions and boost your mining journey!

Recommended news

LianLi welcomes visitors to Booth TB09b at iTherM 2025. discover advanced liquid cooling solutions for AI, HPC, and next-generation data centers.

Looking for a crypto mining container for sale? Compare crypto mining containers, cooling types, capacity, and real deployment tips. Find the best crypto mining containers for sale for mining farms in 2025.